The 2023-24 Federal Budget offers a $4.2bn surplus; the first in 15 years. The surplus was driven by a surge in the corporate and individual tax take. High commodity prices, inflation, and high employment have all pushed up corporate and individual tax receipts. But the gains can't be relied on long term. The Budget is expected to deliver a deficit of $13.9 billion in 2023-24, and a $35.1bn deficit in 2024-25.

While remaining persistently high for longer than anticipated, inflation is expected to fall from 6% to 3.25% in 2023-24.

The $3bn energy relief partnership with the states and territories and the temporary price cap on gas and black coal, are estimated to lower inflation by 0.75% in 2023-24.

Gross debt to GDP is expected to peak lower and earlier at 36.5% of GDP in 2025-26. While $154bn less than the March 2022 expectations, it is an eye watering $1.015 trillion. Net debt rises steadily to 24.1% of GDP to $702.9bn in 2026-27. And, this is assuming the Government can deliver on its anticipated savings reigning in the National Disability Insurance Scheme from a growth rate of 14% to 8%.

Growth is expected to slow. Real GDP growth is expected to slow to 1.5% in 2023-24, before rising to 2.25% in 2024-25.

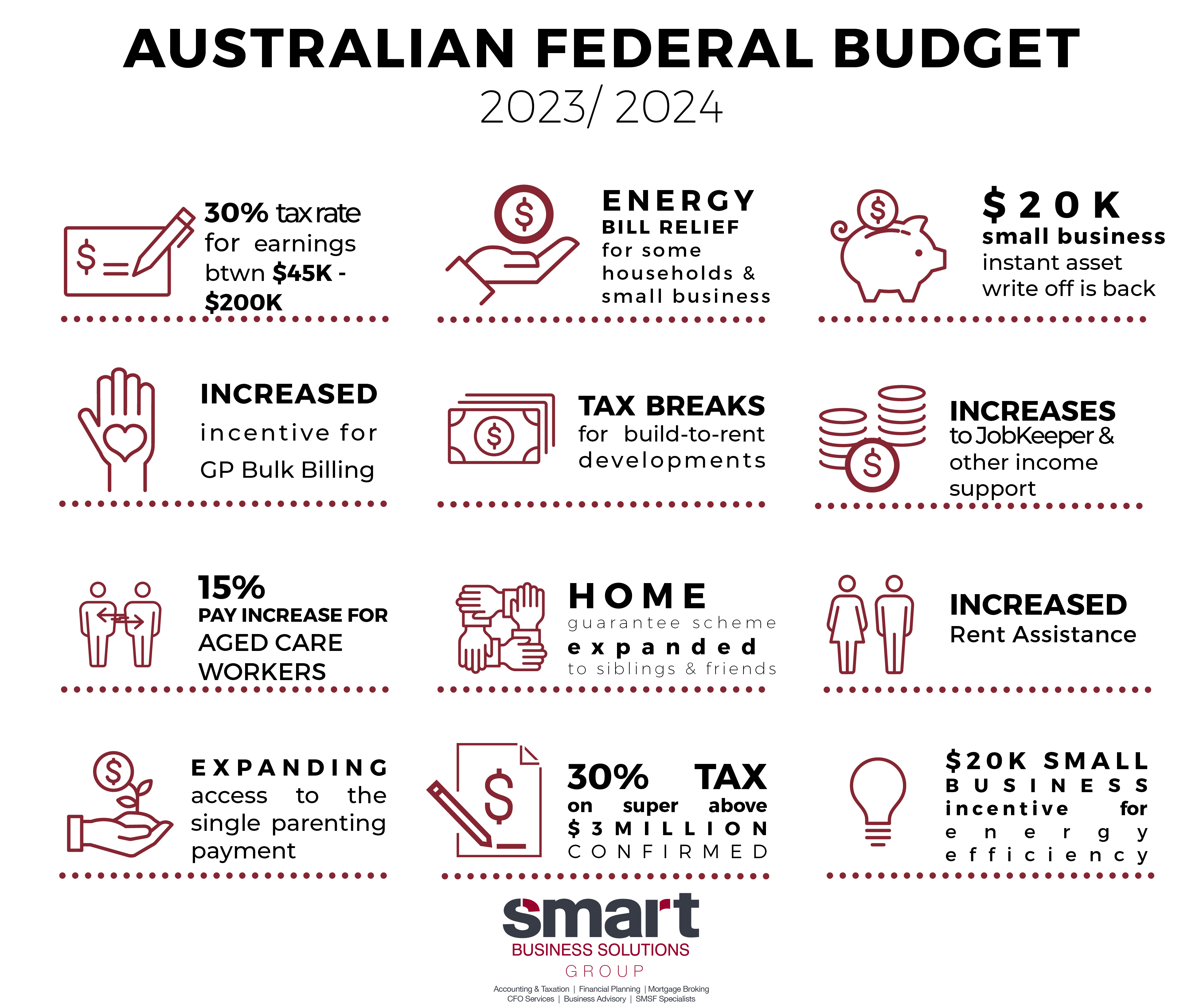

As Australia's highest marginal tax bracket impacts more individuals, a growing number of Australians face rising tax obligations due to "bracket creep," where wage growth outpaces tax rate adjustments. This trend is expected to persist, with tax-efficient strategies the backbone for financial advice to help individuals secure long-term wealth.

Discover 9 essential financial planning tips to help new and expecting parents manage the costs of parenthood with confidence and ease.

The Taxable Payments Annual Report (TPAR) is a mandatory report for Australian businesses in certain industries to disclose contractor payments to the ATO by August 28 each year, ensuring accurate tax reporting.