The average price of a home in NSW is $1,184,500, the highest in the country. Canberra is next at $948,500, followed by Victoria at

$895,000, with the Northern Territory the lowest at $489,2001. With the target cash rate expected to remain steady at a 12 year

high of 4.35% over 2024, the pressure is on parents and family to help the younger generation become homeowners.

Over the last 15 years, home ownership has fallen from 70% to 67% of the population. Over time, declining home ownership

will increase the wealth gap in Australia as for many, home ownership is a significant factor in wealth accumulation. According to the

Actuaries Institute, wealth inequality is significantly higher now than in the 1980s, with the wealthiest 20% of households currently having

six times the disposable income of the lowest 20%2.

The Domain’s

First Home Buyer Report 2024

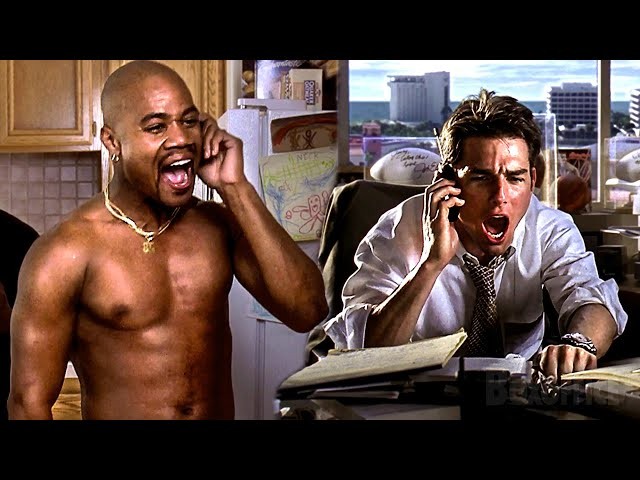

estimates the time for a couple aged between 25 and 34 to save a 20% deposit for an entry level home to be 6 years and 8 months in Sydney,

and 5 years and 5 months in Melbourne (the Australian average is 4 years and 9 months). In that time, they are begrudgingly paying rent (or

staying with Mum and Dad).

Ensure clarity and protection by documenting loan terms for your home purchase with legal guidance. Consulting a financial adviser is

key to assessing eligibility for schemes aiding first-home buyers.

ALL DAY CONFERENCE @ Mornington Racecourse

6 May 2025 - 8:30am - 5:30pm

In today’s fast-changing world, staying competitive means embracing new trends and technologies. At B.I.T.E.

Conference 2025, you'll discover groundbreaking strategies and tools—like A.I. and robotic process automation—designed to

help you navigate and succeed in the evolving business landscape.

Treasury has released exposure draft legislation for Payday Super that will require employers to pay superannuation at around the same time as salary and wages are paid to the employee. The changes are proposed to commence from 1 July 2026.

Shannon Smit dives deep into the compelling world of using self-managed super funds (SMSFs) to invest in property. With her signature energy and expertise, Shannon explains the mechanics of SMSFs, contrasting them with retail and industry super funds, and revealing the unique power they offer individuals to take control of their financial future.

What does it take to turn a modest property portfolio into a self-sufficient powerhouse? In this episode of The Accountant That Builds, Shannon Smit invites you into the fascinating journey of property investment, revealing the key steps, strategies, and mindset shifts that can transform two properties into a thriving, cash flow-neutral portfolio.

The Government’s big moment in the 2025-26 Federal Budget was the personal income tax cuts. Income tax cuts are a dazzling headline but in reality they deliver a tax saving of up to $268 in the 2026-27 year, with a tax saving of up to $536 from the 2027-28 year.

Paying off your mortgage is a significant financial milestone, but once you’ve reached the halfway mark, what’s the best next step? Should you continue aggressively paying it down, start investing, or focus on building your superannuation?

If you’re wondering whether it’s possible to finance your wedding, the answer is yes. A wedding loan could help cover your expenses while allowing you to spread the cost over time.

Self-Managed Super Funds (SMSFs) offer Australians greater control over their retirement savings, and property investment is one way people can take advantage of this flexibility.

Retail fitouts require a strategic approach to attract customers and drive sales. A visually appealing and functional layout can influence purchasing behaviour, making the investment critical.

The Fringe Benefits Tax year (FBT) ends on 31 March. We explore the problem areas likely to attract the ATO’s attention.

On 31 March, the Fringe Benefits Tax (FBT) year ends. With the ever increasing budget deficits, the ATO will be reviewing whether all employers who should be paying FBT are, and that they are paying the right amount. Who needs to lodge a FBT return? Find out here.

Treasury has released exposure draft legislation for Payday Super that will require employers to pay superannuation at around the same time as salary and wages are paid to the employee. The changes are proposed to commence from 1 July 2026.